Beyond Cryptocurrency: Enterprise Applications Reshaping Blockchain’s Future

The Enterprise Blockchain Renaissance

While cryptocurrency markets have experienced dramatic volatility, enterprise blockchain applications have quietly evolved into mature solutions addressing fundamental business challenges. At 5IR Funds, we see the enterprise blockchain sector entering a new phase of pragmatic adoption, focused less on speculation and more on delivering verifiable business value.

This shift represents a significant opportunity for founders building blockchain infrastructure and applications. The most promising developments are occurring in supply chain transparency, digital identity systems, and tokenized real-world assets—areas where blockchain’s properties of immutability, transparency, and disintermediation solve longstanding business problems.

Supply Chain: From Visibility to Verification

Supply chain management represents one of blockchain’s most mature enterprise applications, moving beyond basic tracking to enable verification and trust between parties.

Global trade today involves complex networks of suppliers, manufacturers, shippers, and retailers, often with limited visibility and trust between parties. Blockchain platforms like TradeLens (IBM/Maersk) and VeChain have demonstrated how distributed ledgers can provide end-to-end visibility while ensuring data integrity1.

However, the next generation of supply chain blockchain solutions is moving beyond visibility to verification, using the technology to authenticate product origins, certify compliance with regulatory requirements, and validate ethical sourcing claims. This evolution addresses the estimated $323 billion annual market for fake goods by enabling immutable product provenance tracking2.

For founders in this space, the opportunity lies in developing industry-specific solutions that combine blockchain with other emerging technologies. For example, the integration of IoT sensors, AI analysis, and blockchain verification creates comprehensive systems that can monitor conditions, predict issues, and provide tamper-proof records—all critical capabilities for industries like pharmaceuticals, food safety, and luxury goods.

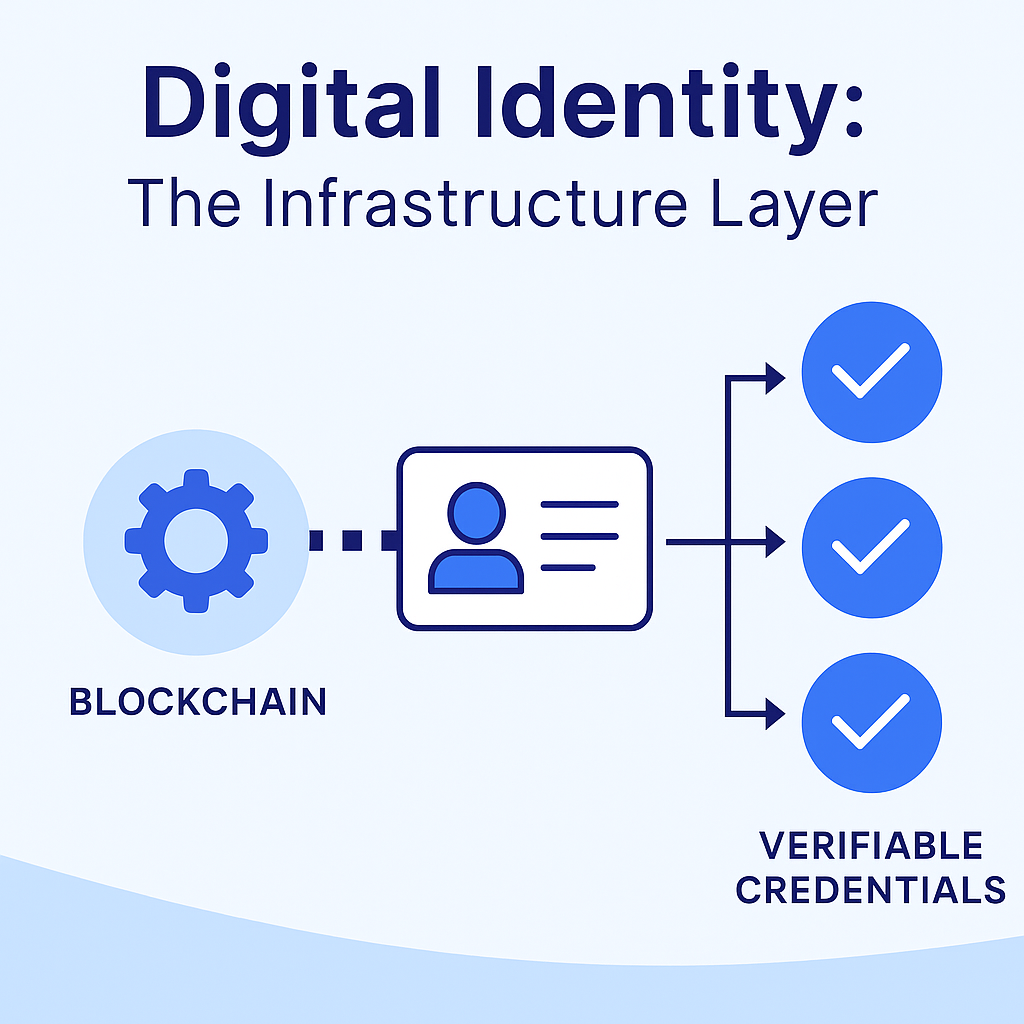

Digital Identity: The Infrastructure Layer

Perhaps no area of enterprise blockchain shows more promise than digital identity—the fundamental infrastructure layer for secure, privacy-preserving interactions in the digital economy.

Traditional identity systems suffer from fragmentation, security vulnerabilities, and privacy concerns. Blockchain-based identity solutions offer a compelling alternative: self-sovereign identity systems that give individuals control over their personal data while providing organizations with verifiable credentials they can trust.

Projects like the Decentralized Identity Foundation (backed by Microsoft, IBM, and others) are establishing standards for interoperable identity systems that could transform everything from financial services to healthcare3. The economic value is substantial, with a recent analysis by Gartner suggesting that blockchain-based identity systems could reduce identity fraud by 50% by 20284.

For founders, the opportunity extends beyond creating the foundational identity protocols. The more immediate commercial opportunities lie in building industry-specific applications on top of these protocols—solutions that address concrete use cases like know-your-customer (KYC) verification, healthcare credentialing, or educational certification.

Tokenized Assets: Digitizing the Physical World

The tokenization of real-world assets represents blockchain’s next major frontier, combining the technology’s strengths in creating digital scarcity with the vast market for physical and financial assets.

By representing assets like real estate, commodities, art, or securities as blockchain tokens, these systems enable fractional ownership, automated compliance, and dramatically increased liquidity for traditionally illiquid assets. The potential market is enormous—the global real estate market alone exceeds $300 trillion5.

Regulatory clarity is gradually emerging, with jurisdictions like Singapore, Switzerland, and the UAE establishing frameworks for tokenized assets. This regulatory progress, combined with improvements in scalability and security, is creating opportunities for startups focusing on specific asset classes or industry verticals.

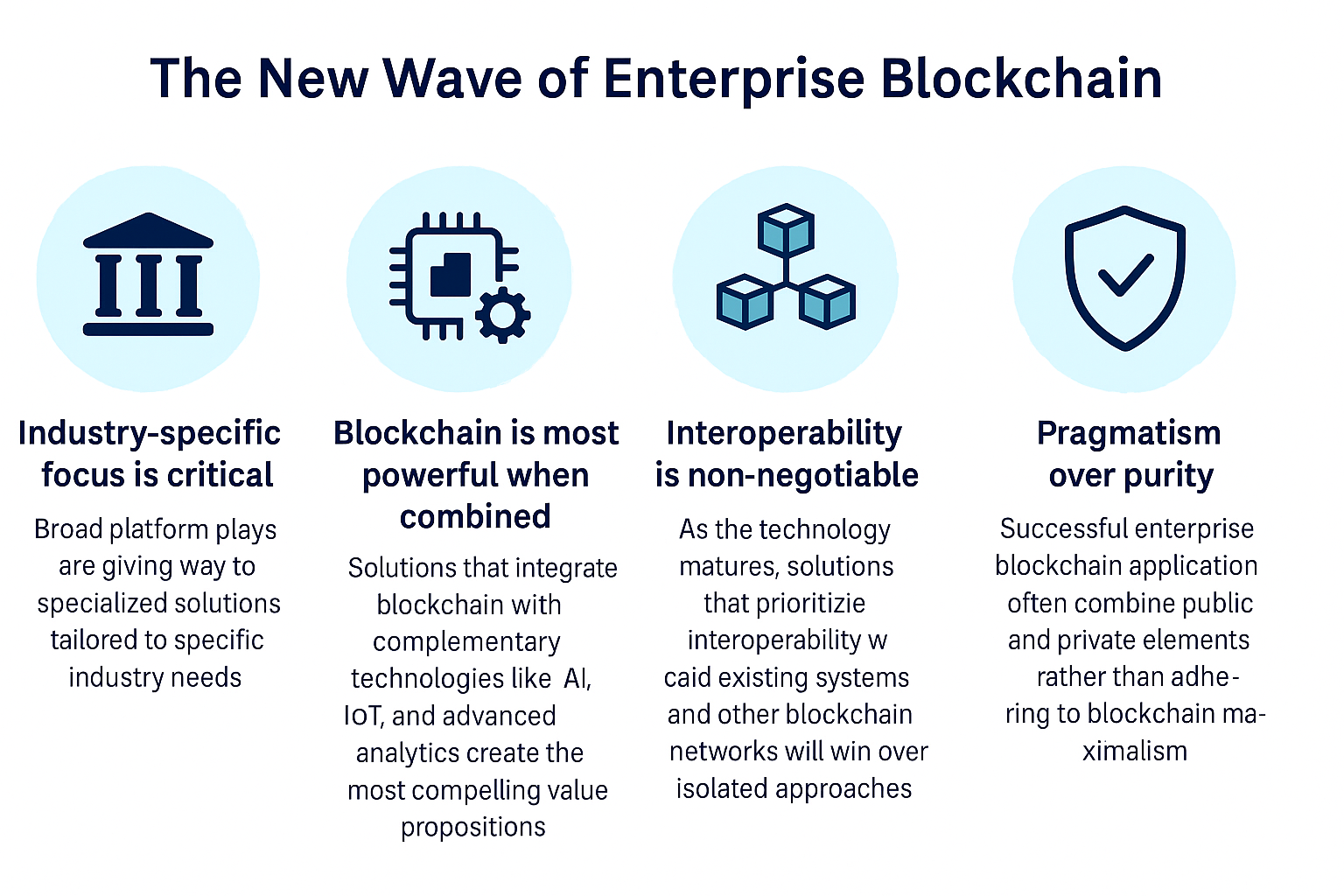

The New Wave of Enterprise Blockchain

For founders building enterprise blockchain solutions, the key insights from this evolving landscape are:

Industry-specific focus is critical

Broad platform plays are giving way to specialized solutions tailored to specific industry needs.

Blockchain is most powerful when combined

Solutions that integrate blockchain with complementary technologies like AI, IoT, and advanced analytics create the most compelling value propositions.

Interoperability is non-negotiable

As the technology matures, solutions that prioritize interoperability with existing systems and other blockchain networks will win over isolated approaches.

Pragmatism over purity

Successful enterprise blockchain applications often combine public and private elements rather than adhering to blockchain maximalism.

The enterprise blockchain sector has evolved past the inflated expectations of earlier years into a phase of practical implementation. For founders who understand the technology’s genuine capabilities and limitations, this represents an unprecedented opportunity to build solutions that transform how businesses create and exchange value.

References

- World Economic Forum. (2022). Redesigning Trust: Blockchain Deployment Toolkit.

- Organization for Economic Co-operation and Development. (2023). Trade in Counterfeit and Pirated Goods: Value, Scope and Trends.

- Decentralized Identity Foundation. (2023). DIF State of Identity Standards.

- Gartner. (2022). Predicts 2023: Blockchain-Based Digital Identity Initiatives Will Transform Fraud Prevention.

- MSCI. (2023). Real Estate Market Size Report.